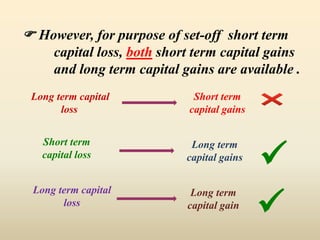

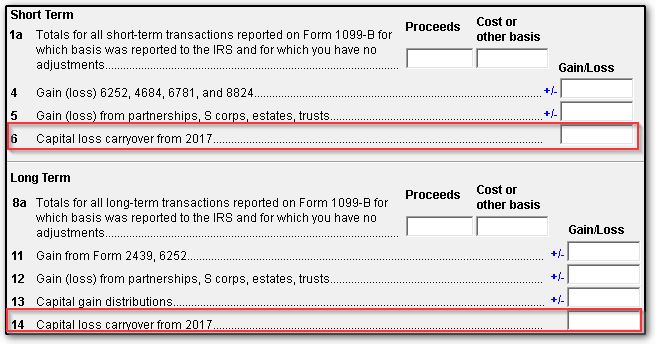

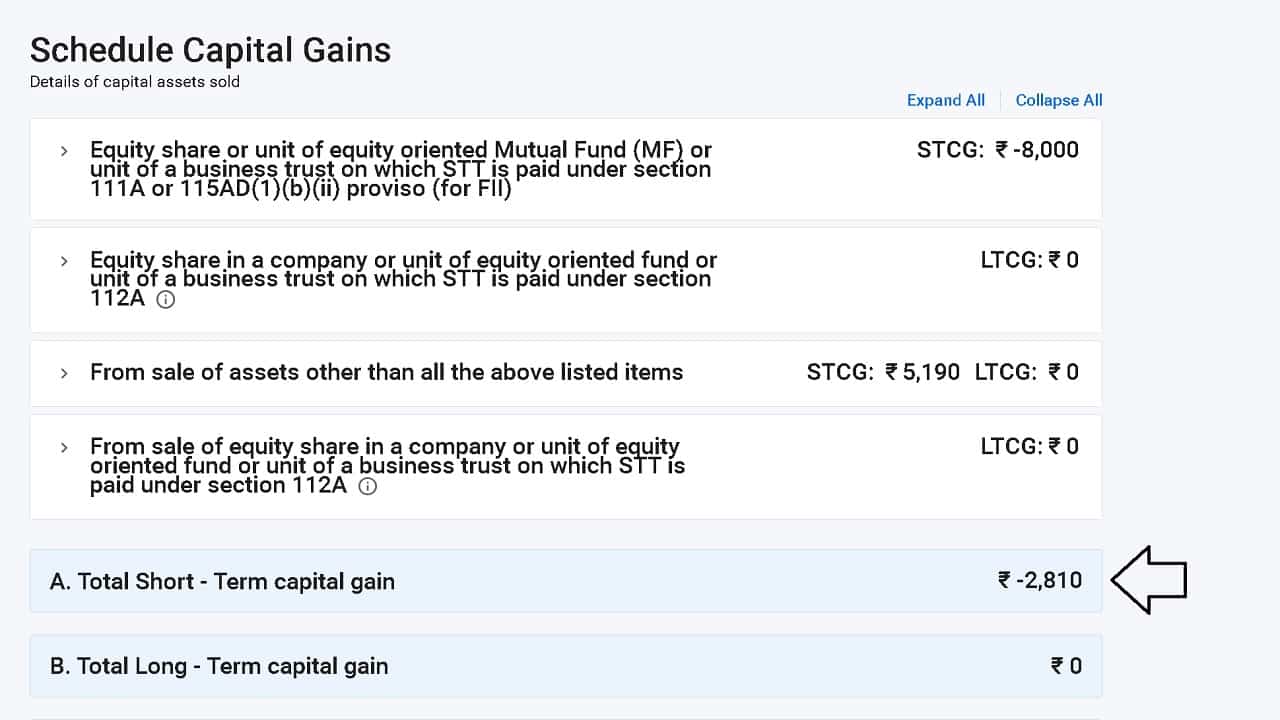

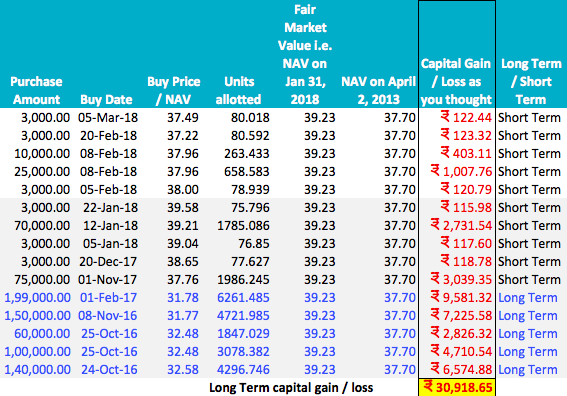

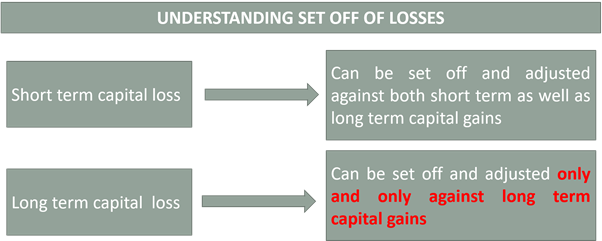

swapnilkabra on X: "Let us now understand how losses are set off in income tax. how losses are set off in income tax. 🔸Short term capital loss can be set off and

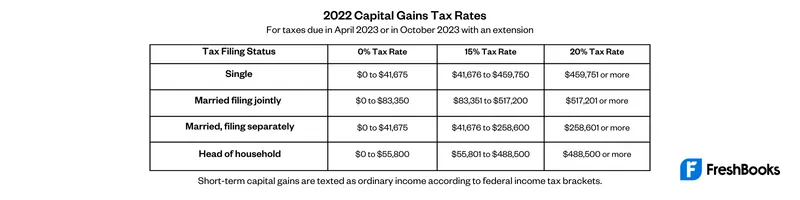

ET Money on X: "Now, let's discuss short-term capital gains. You cannot use the tax harvesting strategy on STCG Why?🤔 Because STCGs incur a flat 15% tax But you can use the

:max_bytes(150000):strip_icc()/capital-loss-carryover.asp-Final-5f47a643e43d4315b189e8b86d1b0a94.png)